ORANGE COUNTY, Fla. — The slight tick down in the inflation rate last month did little to ease the pain of families stretching their budgets.

>>> STREAM CHANNEL 9 EYEWITNESS NEWS LIVE <<<

Moody’s Analytics Chief Economist Mark Zandi said the average family is now paying hundreds of dollars more per month to maintain their lifestyle.

“The typical American household is spending $450 a month more now than a year ago for the same goods and services,” he said.

READ: US inflation dips from 4-decade high but still causing pain

April’s year-over-year inflation rate was 8.3%, down slightly from the 8.5% price increases the nation saw for the month of March.

Gas, housing and food were some of the major sources of the hikes. Gas prices have been volatile since Russia began preparations to invade Ukraine. The area is also known for its wheat production, driving food shortages worldwide.

“Whatever we get, we got to keep trying to make it stretch,” Russell Glover said, as his wife loaded groceries into the back of their car in Orlando. “Every time we come to the store, something is higher and higher.”

READ: High inflation leaves food banks struggling to meet needs

Investors have watched their portfolios tumble recently as the Federal Reserve tries to get inflation under control. April’s 8.3% rise was down slightly from March.

But still so high that some people think it’s unacceptable.

Grocery store prices are driving some of it, thanks to the war tearing through Ukraine, a major exporter of wheat.

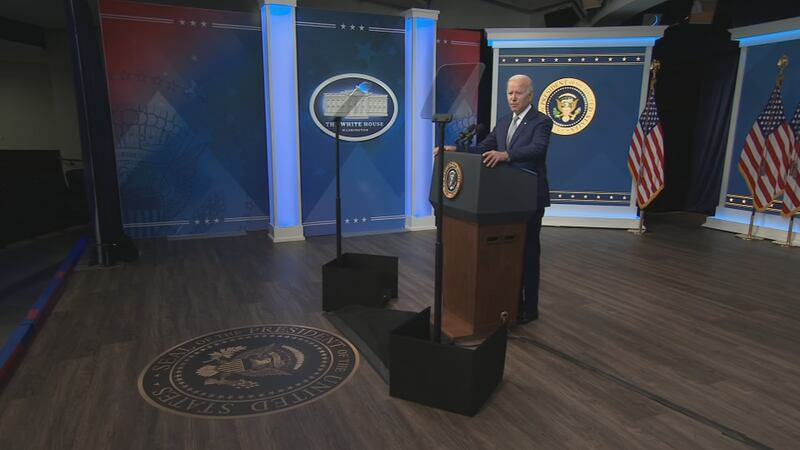

READ: Biden says inflation is his ‘top domestic priority,’ slams GOP ahead of midterm races

The war has also sent gas up to record highs, with some Orlando stations selling fuel for about $4.50 a gallon on Wednesday.

China’s continued attempts to stamp out COVID-19 are also straining the supply of other goods.

Because these all are beyond U.S. control, no one is sure when the inflation rate will return to Earth.

EXPLAINER: Recession fears grow. But how high is the risk?

“We know the (federal government) has signaled that they’re going to raise throughout the year,” said Keith Heritage with Heritage Financial. “But we really don’t know when that’s going to stop if that’s going to go further than that.”

Heritage said the stocks will be easier to predict, inevitably bouncing back like they’ve done every few years.

Click here to download the free WFTV news and weather apps, click here to download the WFTV Now app for your smart TV and click here to stream Channel 9 Eyewitness News live.

©2022 Cox Media Group