DELTONA, Fla. — A Deltona family suddenly had $3,500 wiped from their bank account after some bizarre transactions with Walmart. Their debit card was hit with fifteen different charges from Walmart’s website in less than five minutes for items they said they didn’t order.

The first sign of trouble for Jason Hardy and his wife was a flood of alerts she received on her phone in July.

Hardy told Action 9, “One after another, and she said, ‘You might want to look at the bank account, because I’m getting all these weird transactions.’”

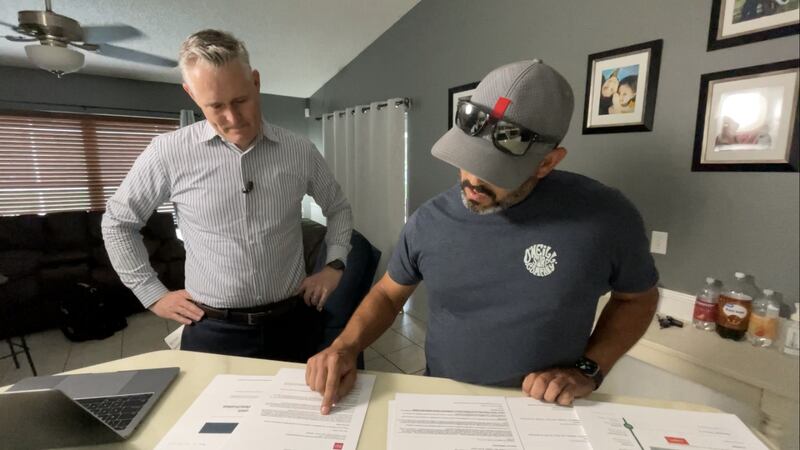

He pointed to his account showing fifteen transactions were done in a four-minute span on Walmart.com. Whoever made the transactions ordered a total of 60 nightstands.

Hardy said, “It wasn’t good, because you know, I can’t afford to be paying, $3,500 for stuff that I didn’t buy.”

The $3,500 was taken from his account. What’s more bizarre, the tracking information from the packages show they were all shipped from Hong Kong to different addresses near his Deltona home. Each of the packages had different weights even though all of the nightstands ordered were the same model.

“Some of them weighed less than one pound. One was 0.2 pounds. The highest one I think was about 14 pounds, " Hardy said.

Hardy told Action 9, Walmart removed $900 in charges right away and Wells Fargo returned the remaining $2,500 calling it a provisional credit. But he said, Wells Fargo later took the money back and in an email wrote, “… we concluded this is a dispute between you and the merchant.” Hardy felt stuck in the middle because he said Walmart told him to deal with his bank.

James E. Lee, the Chief Operating Officer for the Identity Theft Resource Center said, “When you find yourself in that no man’s land between the merchant and the financial institution, the reality is you just don’t have a lot of recourse.”

Lee said challenging the transaction like Hardy did is a good first step. He also recommends filing a police report, making a complaint on the FBI’s internet crime website and alerting the Federal Trade Commission.

He also pointed out consumers have more protection using a credit card for online transactions than a debit card.

READ: Action 9 helps consumer get money from their utility’s surge protection warranty

At this point, no one has confirmed how the account was compromised, but the couple did have their debit card on file with Walmart to order groceries.

As for what could be going on with bizarre package deliveries, Lee said often drug traffickers will use this strategy to import illegal substances into the United States.

“They’re being shipped in different quantities, different size boxes, that might look like it’s a legitimate item,” he said.

After Jason Hardy filed complaints with the Better Business Bureau and Action 9 reached out to Walmart, the company sent him an email acknowledging the transactions weren’t his. Walmart also indicated the seller has been removed from its website. Hardy said that email from Walmart then prompted Wells Fargo to return the remaining $2,500.

While he’s thankful to have the money back, fighting for more than two months was less than ideal for Hardy.

He said, “Very frustrated, very frustrated because I did not make these purchases.”

Walmart never responded to Action 9 Consumer Investigator Jeff Deal’s inquiries or explained how this happened.

Wells Fargo issued this statement:

We are happy to report that we resolved the issue for our customer. To make a claim decision, we rely on accurate information from both our merchant and our customer. Once that information is received and correct, we solve the matter for our customers.

It also offered these additional tips:

· Monitor your account activity closely, and be sure to report anything suspicious right away.

· Set up alerts so you can be notified if anyone makes a purchase or withdrawal on your account.

· If you find a suspicious card transaction, call the number on the back of your debit card immediately.

· We encourage people to visit Wells Fargo’s online security center to learn about common scams and how to avoid them.

©2023 Cox Media Group