ORLANDO, Fla. — Action 9 investigates a home-selling offer that left dozens of local families facing legal trouble and big fees.

“It sounded like free money?” consumer investigator Todd Ulrich asked.

“Absolutely, it did,” Carla Turman replied.

Turman said she received a call after applying for a payday loan online. She said someone from the Homeowner Benefit Program told her she qualified for $1,300. “And they can have my cash in my account within a couple of days,” Turman added.

According to Turman, she made an appointment, and a notary showed up in her driveway, not to explain the program, just to get her signature.

“Asked for ID, asked me to sign and said you’ll have the money in your account shortly,” Turman said she was told.

She admits she didn’t read the contract, but she never expected a payday loan offer to morph into a home seller’s nightmare.

“Did anyone from this company say it was a program to sell your home?” Ulrich asked.

“No. They did not,” Turman replied. “It felt awful. It felt humiliating.”

The reality was a gut punch Turman discovered when she tried to sell her lakefront Orlando home. MV Realty based in South Florida blocked the sale.

Read: ‘How could this be allowed’: Homeowners furious over Florida law they say is unfair

Its Homeowner Benefit contract she had signed gave the company a 40-year exclusive right to list and sell her home because she accepted $1,300 upfront.

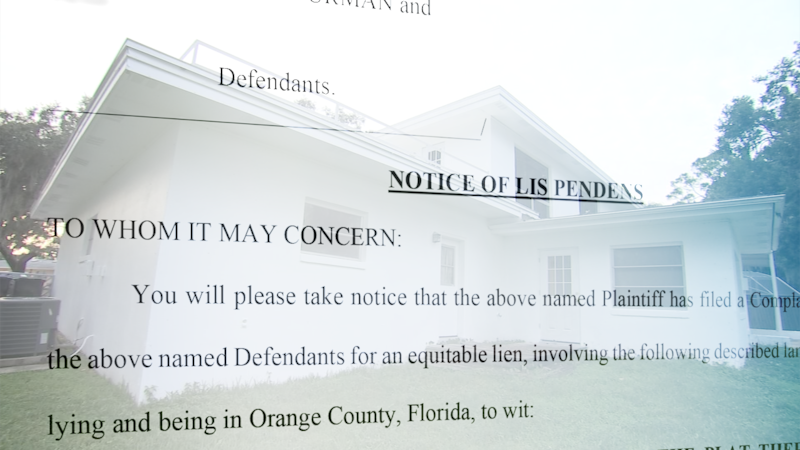

In Orange County court, MV Realty placed a lien on her property to enforce its right to sell at 6% commission.

“I felt trapped,” Turman said.

That same contract included a cancellation penalty of 3% of her home’s value.

Action 9 first investigated the company two years ago when Eleanor Gardner signed a contract she did not understand.

“I don’t want anything to do with those people,” Gardner said.

Since then, Action 9 found MV Realty filed at least 60 lawsuits against homeowners across central Florida to enforce liens that blocked selling their homes unless they used its real estate company. Florida’s attorney general has an active investigation.

A joint investigation by Cox Media Group, WFTV’s parent company, in seven states, uncovered similar complaints from homeowners who felt trapped by 40-year sales contracts.

In many cases homeowners had no idea what they were signing.

“I said, Lord have mercy’,” Julie Henry said.

Henry, who lives in Georgia, thought it was a grant, only to feel blindsided by MV Realty’s demand to use them to sell her home or pay thousands to cancel.

“I didn’t see no contract. I didn’t see anything,” Henry said.

“Many of these companies use a lot of techniques to pressure someone to sign fast,” said Sarah Mancini with the National Consumer Law Center. She reviewed MV Realty complaints. She is concerned low-income homeowners are offered money upfront in a binding and confusing contract that could be costly.

“Ultimately, down the line they could end up owing much more than the money they were given up front,” Mancini said.

Ulrich contacted MV Realty. A company representative said that’s not how it operates. They said Turman and Henry met with realtors who fully disclosed the 40-year contract, fees and penalties before they signed, and no misleading sales tactics were used. The company said it has thousands of satisfied customers and a small number of complaints.

Turman said she was forced to list with MV Realty months after a red-hot real estate market had cooled and claims she’ll lose thousands selling her home now.

“I’m not getting what I’m asking for,” Turman said.

If someone offers you quick cash to sell your house, before you sign, review traditional real estate listing agreements that last months, not years, and don’t have surprise fees.

MV Realty also told Action 9 that its agent found a buyer for Turman’s home but she demanded a lower commission, and that was a contract violation. The company has also added contract disclosures that the company will file legal documents about your exclusive contract, and if you use another realtor, MV still collects its 6% commission.

MV Realty response:

That is not the way MV Reality’s business operates. Notary visits are the last step in our process. Once someone opts in to receive information from MV Realty -- either by visiting our website or a partner website – we prescreen the application before assigning a realtor to speak to the customer. The realtor carefully explains the homeowner benefit program and walks the customer through the terms of the homeowner benefit agreement so that there is no misunderstanding. MV then determines the value of the home and provides a written offer. Only after the homeowner has verbally agreed to the compensation offer and terms of the contract does MV schedule a meeting and notary visit – based on the homeowner’s availability for the actual signing/notary visitation. The homeowner receives the money immediately but can rescind the agreement for up to three days after signing.

It is important to note that during a phone call we had with Ms. Turman on 9/15/2022, she reported that she had a positive experience listing her home with MV Realty, but she threatened to go to the media to complain about MV Realty if we didn’t eliminate the contractual commission of 3%. An email summarizing that call is attached for your reference. (Note: Subsequently, the sale our agent negotiated fell through because the property had been under-appraised by $54,000. The buyer was willing to pay $36,000 above the appraised price, but Ms. Turman declined the offer and removed the property from the market.)

Re: Eleanor Gardner, we are sorry to hear that she is ill. That said, the responses we sent you previously for your earlier story are still accurate. Below I summarize a few relevant points from that response:

- MV Realty did not knock on Ms. Gardner’s door. She submitted an inquiry to MV Realty either through our website or an affiliate, to which MV responded with a phone call. We did not target her for solicitation – it is not how our business operates.

- Ms. Gardner received and kept $1,000 from MV Realty. She has not raised any dispute about the service we have provided or raised any claim that we have restricted her ability to do whatever she wants with her home. But it appears she now wants to cancel the contract now and keep the $1,000.

- Ms. Gardener contacted us looking for cash and was told verbally and in writing that the HBA is a 40-year contract, which she agreed to. She has never disputed that what she was told is consistent with what is in the agreement.

- After being paid by MV Realty, it would appear that Ms. Gardener is attempting to use WFTV ABC Orlando’s consumer protection team to help her keep the money we paid her and avoid having to honor the standard business contract she entered into with MV Realty. We are pro-consumer and pro-homeowner but we are also running a business based on providing upfront cash incentives in exchange for the right to sell the homeowner’s property – if and when they decide to do so. Despite the superficial optics of this situation, we believe her actions are unfair.

- The timing of the sending of her contract was slowed due to Covid-19 restrictions, wherein the MV Realty office was closed for a period of time. Employees could not get to the office where her agreement was located. This created a backlog of agreements. There is, however, no dispute that Ms. Gardner has been aware of the agreement since it was signed by her and that she received and retained $1,000 from MV.

It is clear that the discrepancies some of the homeowners stated really have nothing to do with disclosures or fine print or not knowing what they signed. It is clear they had every intention of taking the money and willfully breaching their contracts without giving MV Realty any opportunity to sell their home. Which is only what the Homeowner Benefit Program is. MV has over 30,000 HBA clients; we have thousands of satisfied customers, and the small number of complaints does not even equate to the large number of satisfied HBA clients. As a news outlet that is supposed to be objective and report facts, We beg you to ask those who have criticized- they got the money in exchange for something, what is it that they suggest they did to uphold their end of the agreement? They stated they did not understand, but what did they think they received money for, and what single step have they taken to honor whatever they say they thought the agreement was for, they certainly understood it was an opportunity for us to be their agent, show us one step they’ve taken to give MV Realty the opportunity to be their agent?

The memorandum (not a lien) serves as a public notice of the homeowners’ commitment to give MV the opportunity to represent them in the sale of their home. This is to protect MV in the event a homeowner attempts to sell their home without allowing MV the opportunity to be their agent.

The company has a strong ongoing commitment to consumer disclosures and is constantly adding to them. Some of these disclosures include, but are not limited to, clear unambiguous language of the contract itself in large font that includes the description of the 40-year term, the filing of the memorandum, and the termination fees all in BOLD and the circumstances when they would be due.

The same disclosures are again emphasized in a single page leave-behind document signed by the customer. Additionally, the company’s website prominently displays these same key program features. As well as an extensive FAQ section.

MV Realty works diligently to respond to any inquiries from the attorney generals. Our goal is zero complaints. The vast majority of participants in our HBP have a great experience with us, as is evidenced in their five-star reviews as well as in the number of sales we have closed for them -- more than 700 to date.

The point of the HBA is for someone to give our firm the opportunity to list their home for sale. While the agreement term covers 40 years, our opportunity to represent the seller is for only six months, after which time, if they can sell their home successfully on their own or with another broker at the same terms, they do not owe anything to MV.

©2022 Cox Media Group