ORLANDO, Fla. — A local family felt devastated by a $160,000 online banking mistake.

That's how much money they lost for weeks after clicking on the wrong account.

When they couldn't get their cash restored, they turned to Action 9 for results.

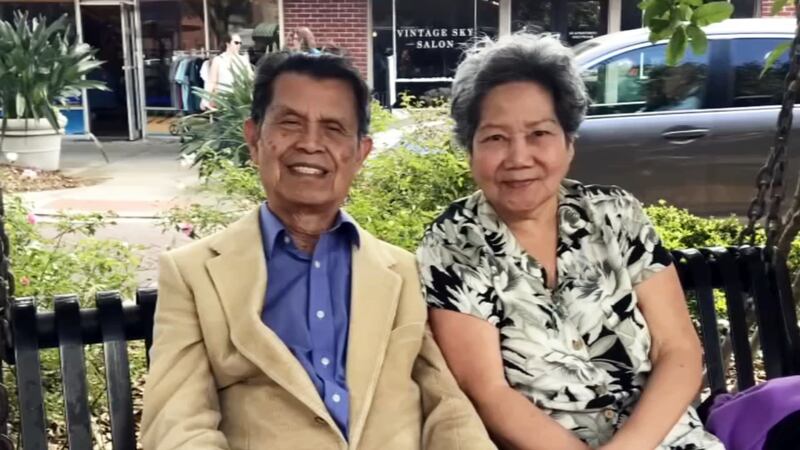

Saing Samnang and Srine Samnang worked hard to save money and raise a family through 65 years of marriage.

Read: Cruise customers grow frustrated over delayed refunds

“I’m 89, my wife is 85,” Saing said.

But with a mouse click, their life savings vanished.

“By accident I put in the credit card account the amount of $160,000, a lot of money,” Saing said.

By mistake, he transferred $160,000 online from their Bank of America checking account to their Bank of America credit card. They thought it would be a simple fix.

The couple’s daughter, Vanna Sun, said, “Who in their right mind would transfer that much money into a credit card account?”

Their daughter and their son, Sam Samnang, tried to get the money back. After three weeks of calls, they felt hopeless.

“They’re crying, they’re in tears every time they call me. She’s losing sleep, that’s all the money they had,” Sam Samnang said.

“I said why, I work so hard they took my money, all of it,” Srine Samnang said.

Read: Are auto insurance COVID-19 credits really saving drivers money?

Overpayments to credit card accounts like the one the Samnang’s made to Bank of America, are regulated by federal consumer protection regulations.

The Federal Reserve rule says a bank must refund any overpayment within seven business days after a written request. And have to make a good-faith effort to return the funds.

But experts warn there could be exceptions.

“When very large sums are overpaid, the banks often will suspect money laundering, so they’ll want to take a good hard look at that,” said Jack Gillis, Executive Director of the Consumer Federation of America.

Action 9 contacted Bank of America that said it would review their account.

Two days later, the Samnang's had all the money returned to their account, plus $150 for their trouble.

“I’m happy, I heard that you come to visit me today,” Srine Samnang said.

Read: New fees on dental bills during pandemic surprising patients

Online banking mistakes are common although this dollar amount is extreme.

If you’re feeling ignored, contact the Consumer Financial Protection Bureau with your banking complaints.

© 2020 Cox Media Group