ORLANDO, Fla. — A Central Florida cancer patient thought she was fully insured, but she was billed for a $7,000 test.

She's covered by a major insurance company that has come under fire for changing coverage and sticking patients with big bills.

Action 9's Todd Ulrich investigated how that can happen.

Cindee Peterson said her Mayo Clinic oncologist found her breast cancer to be so aggressive that he wanted a PET scan to see if it had spread.

"It was something my doctor said I absolutely needed for treatment," she said.

Her insurance company, Anthem Blue Cross Blue Shield, pre-authorized the scan.

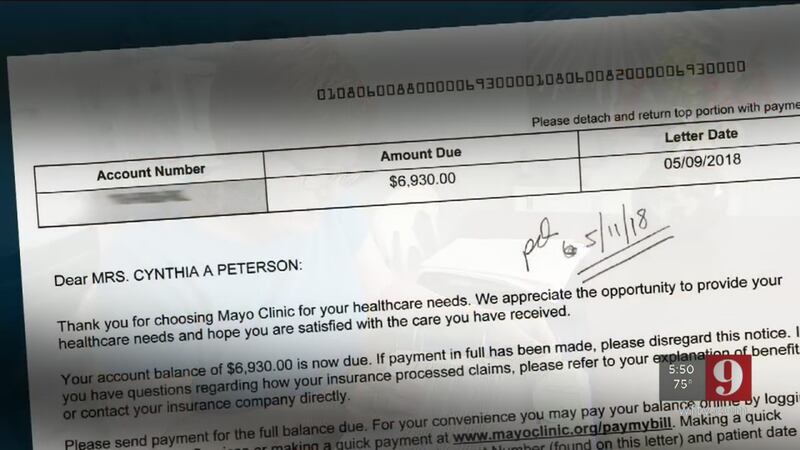

Peterson said she received a $7,000 bill four months later, because Anthem refused to cover the scan.

"I'm angry," she said. "I'm frustrated. I'm appalled."

Peterson has been a nurse for 40 years, so this denial was a personal challenge, she said.

She appealed three times, documenting how the scan met her insurer's requirements.

"I will push it to the limits, because I want them to pay it," Peterson said.

Anthem denied her appeals.

Peterson then discovered Anthem's new policy that denies outpatient coverage for hospital scans. It now requires cheaper testing at independent centers.

Anthem is also the insurer now denying emergency room bills in some states by claiming patients didn't need that level of care.

Ken Klein, of the Alliance of Professional Health Advocates, said big policy changes limiting coverage are more common.

"(Patients) need to be concerned about that," he said.

Klein said insurance companies must give patients advance written notice so they're not surprised by denials.

"I signed a contract with your insurance covering XYZ. That covers these procedures and these outcomes. Then you change the deal," he said.

Anthem told Ulrich it denies hospital CT and MRI scans for outpatients, but not PET scans. The same day Ulrich called the insurance company, the insurer called Peterson to say it will now cover her $7,000 scan.

Anthem said its health plans cover medical technologies that provide quality health outcomes.

Those who are denied coverage by their insurer may appeal to the Florida Department of Financial Services.

Cox Media Group